Average Return Calculator

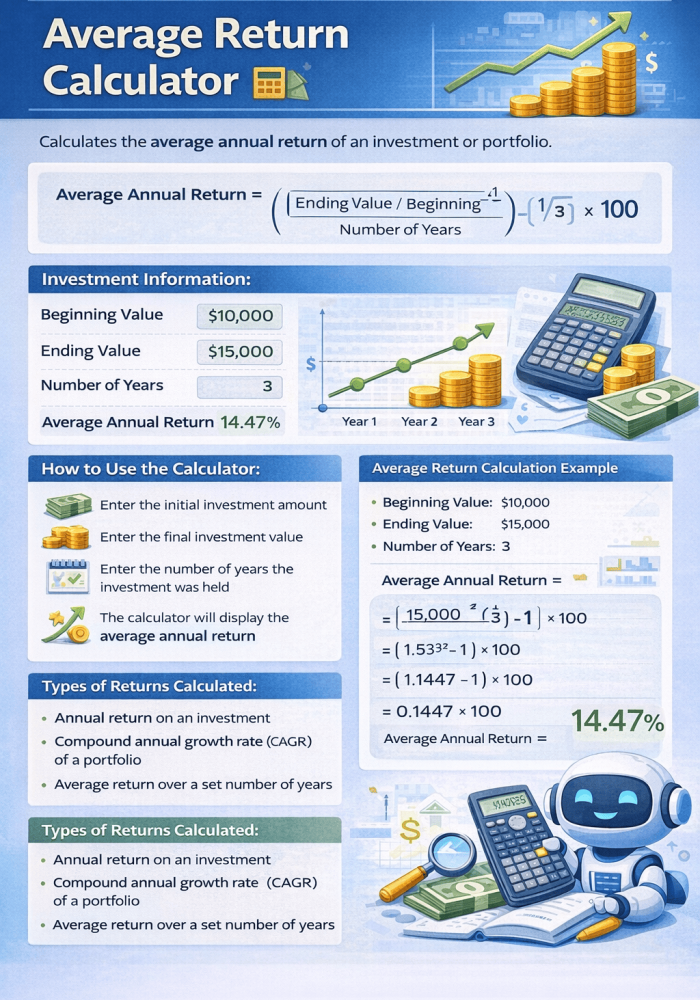

Calculate average returns, compound annual growth rate (CAGR), and analyze investment performance. Compare different investment scenarios and visualize how your investments grow over time with various return assumptions.

Calculation Type

Investment Details

Periodic Returns

Regular Investment Plan

Advanced Settings

Return Analysis

Adjusted Results

Investment Growth Over Time

Investment growth chart will appear here

Return Comparison

Return comparison visualization

Investment Insights

Export Results

Historical Market Returns

S&P 500

NASDAQ

10-Year Treasury

Real Estate (REITs)

Global Stocks

Gold

Common Investment Scenarios

Conservative Growth

Moderate Growth

Long-Term Growth

Retirement Savings

Your Saved Scenarios

No scenarios saved yet. Calculate returns and click "Save Scenario" to store them here.

Understanding Investment Returns

CAGR vs Average Return

CAGR (Compound Annual Growth Rate) accounts for compounding, while simple average return doesn't. CAGR is more accurate for comparing investments over time.

The Power of Compounding

A 10% return for 20 years turns $10,000 into $67,275. Small differences in returns create huge differences over long periods.

Real vs Nominal Returns

Nominal returns don't account for inflation. Real returns subtract inflation to show actual purchasing power growth.

Volatility Matters

Two investments can have the same average return but different CAGRs if one has more volatility (sequence of returns matters).