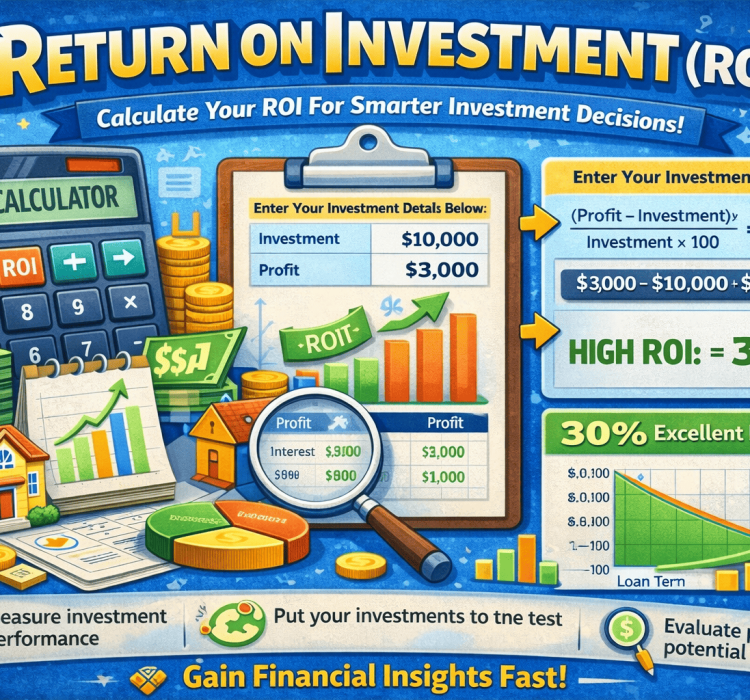

Return on Investment (ROI) Calculator

Calculate your investment performance by determining the return on investment (ROI) and annualized ROI. This tool helps you evaluate the profitability of your investments over time.

Result:

ROI Calculator: Measure Your Investment Returns Accurately

What is ROI and Why Does It Matter?

Return on Investment (ROI) is the ultimate metric for evaluating an investment’s profitability. Our free ROI calculator helps you:

Calculate exact returns on any investment

Compare different opportunities objectively

Make data-driven decisions about your money

Track performance over time

Whether you’re analyzing stocks, real estate, business ventures, or personal projects, understanding ROI is essential for smart investing.

How to Use Our ROI Calculator (3 Simple Steps)

Enter Your Investment Details

Amount invested (principal)

Amount returned (current value)

Investment timeframe

Click “Calculate”

Instant, accurate results

Clear visualization of your returns

Analyze Your Results

Absolute profit/loss

ROI percentage

Annualized returns

Investment duration

Key Metrics Our Calculator Provides

1. Investment Gain

The absolute dollar amount you’ve earned or lost:

Profit = Amount Returned - Amount Invested

2. ROI (Return on Investment)

The percentage return relative to your initial investment:

ROI = (Profit / Amount Invested) × 100

3. Annualized ROI

Time-adjusted return that enables comparison across different investment periods:

Annualized ROI = [(1 + ROI)^(1/years)] - 1

4. Investment Length

The exact duration of your investment in years and days – crucial for accurate comparisons.

Real-World ROI Calculation Examples

Example 1: Stock Investment

Invested: $5,000

Returned: $7,500 after 3 years

ROI: 50%

Annualized ROI: 14.47%

Example 2: Real Estate Flip

Invested: $200,000

Returned: $260,000 after 18 months

ROI: 30%

Annualized ROI: 20.00%

Example 3: Business Investment

Invested: $50,000

Returned: $40,000 after 2 years

ROI: -20%

Annualized ROI: -10.56%

What Constitutes a Good ROI?

| Investment Type | Good ROI Range | Excellent ROI |

|---|---|---|

| Stock Market | 7-10% | 15%+ |

| Real Estate | 8-12% | 20%+ |

| Small Business | 15-30% | 50%+ |

| Bonds | 3-5% | 6%+ |

Note: These are historical averages – always compare to current market conditions.

5 Pro Tips to Improve Your ROI

Reinvest Profits

Compound returns significantly boost long-term ROIDiversify Wisely

Spread risk across different asset classesMonitor Fees

High management fees can destroy returnsTax Efficiency

Use tax-advantaged accounts when possibleRegular Reviews

Rebalance underperforming investments

Frequently Asked Questions

What’s the difference between ROI and annualized ROI?

ROI shows total return, while annualized ROI accounts for time – enabling fair comparison between investments of different durations.

Can ROI be negative?

Yes, negative ROI means you lost money on the investment. Our calculator clearly shows losses in red.

How does inflation affect ROI?

For true performance, calculate “real ROI” by subtracting inflation rate from your nominal ROI.

What’s better: high ROI or lower risk?

The ideal is high ROI with acceptable risk. Use our calculator to compare risk-adjusted returns.

Why Trust Our ROI Calculator?

✅ Bank-Level Accuracy – Precise financial formulas

✅ Instant Results – No waiting, no registration

✅ Privacy Focused – We don’t store your data

✅ Mobile-Optimized – Use anywhere, anytime

✅ Educational Resources – Learn while you calculate